Three best swing trading strategies are Moving Average Crossover, Relative Strength Index (RSI), and Bollinger Bands. These strategies help traders identify potential entry and exit points.

Swing trading is a popular trading style that captures short- to medium-term gains in a stock or any financial instrument. Traders aim to profit from price movements over several days to weeks. Using technical analysis, they identify trends and reversals to make informed decisions.

Moving Average Crossover helps spot trend changes by examining averages over different periods. The RSI measures the speed and change of price movements to identify overbought or oversold conditions. Bollinger Bands use volatility to signal potential market reversals. Implementing these strategies can improve trading performance and decision-making.

Introduction To Swing Trading

Swing trading is a popular trading strategy for many traders. It involves holding positions for several days or weeks. This allows traders to capitalize on short-term price movements.

In this blog post, we will explore three of the best swing trading strategies. These strategies are simple yet powerful. But first, let’s understand what swing trading is and why you might choose it.

What Is Swing Trading?

Swing trading is a method of trading financial assets. Traders hold positions for a short period. This period can range from a few days to several weeks.

The goal is to profit from expected price changes. Swing traders often use technical analysis. They look for patterns and trends in price charts. They also use indicators to make their trading decisions.

Why Choose Swing Trading?

There are many reasons to choose swing trading. Here are some key benefits:

- Flexibility: Swing trading allows you to trade part-time.

- Less Stress: You don’t need to monitor the market all day.

- Profit Potential: Short-term price movements can be profitable.

- Technical Analysis: It relies heavily on chart patterns and indicators.

- Balanced Risk: Swing trading involves moderate risk.

Swing trading suits those who prefer a less intense trading environment. It provides a balance between day trading and long-term investing.

Credit: learn.bybit.com

Key Benefits Of Swing Trading

Swing trading is a popular trading style. It offers several benefits to traders. These benefits make it appealing for many investors. Let’s dive into the key benefits of swing trading.

Profit Potential

Swing trading has a high profit potential. Traders can capture price swings in the market. This approach allows traders to capitalize on both uptrends and downtrends. By focusing on short-term movements, profits can be made in days or weeks.

Here are some points about the profit potential:

- Traders can make money in both rising and falling markets.

- Short-term price movements can lead to quick gains.

- Less exposure to market risk compared to long-term trading.

Time Efficiency

Swing trading is time-efficient. It requires less time than day trading. Traders do not need to monitor the market all day. They can analyze the market after hours and set their trades.

Consider these time efficiency points:

- Less screen time compared to day trading.

- Allows for a flexible trading schedule.

- Suitable for part-time traders or those with other commitments.

These benefits make swing trading a preferred choice for many. It offers both profit potential and time efficiency.

Strategy 1: Moving Average Crossovers

Swing trading is a powerful way to profit from short- to medium-term price movements in the stock market. One of the most effective strategies for swing trading is the Moving Average Crossovers. This strategy helps traders identify potential buy and sell signals by analyzing the interactions between different moving averages.

How It Works

Moving average crossovers involve plotting two moving averages on a price chart. Typically, traders use a shorter moving average (e.g., 50-day) and a longer moving average (e.g., 200-day). The idea is to look for points where the shorter moving average crosses the longer one.

When the shorter moving average crosses above the longer one, it signals a potential uptrend. Conversely, when the shorter moving average crosses below the longer one, it indicates a potential downtrend. These crossovers help traders make more informed decisions based on historical price data.

When To Enter And Exit

Knowing when to enter and exit a trade is crucial for success. For entry points, traders typically look for the shorter moving average to cross above the longer moving average. This crossover suggests a potential buying opportunity.

For exit points, traders look for the shorter moving average to cross below the longer moving average. This crossover suggests it might be time to sell. By following these simple rules, traders can effectively manage their trades and potentially increase their profits.

Here’s a quick summary in a table format:

| Action | Signal |

|---|---|

| Enter (Buy) | Shorter MA crosses above Longer MA |

| Exit (Sell) | Shorter MA crosses below Longer MA |

By incorporating the Moving Average Crossovers strategy into your swing trading, you can take advantage of market trends and make more informed trading decisions.

Strategy 2: Support And Resistance

Support and Resistance is a powerful swing trading strategy. It helps traders identify key levels where price tends to reverse. This strategy is simple yet effective. Let’s explore how to use it.

Identifying Key Levels

To start, identify key levels of support and resistance. Support levels are where the price tends to stop falling. Resistance levels are where the price tends to stop rising.

Use a daily chart to spot these levels. Look for points where the price has reversed multiple times. Mark these areas on your chart.

| Support Level | Resistance Level |

|---|---|

| Price stops falling | Price stops rising |

| Multiple reversal points | Multiple reversal points |

Trading The Bounce

Once key levels are identified, trade the bounce. When the price approaches a support level, it might bounce back up. Similarly, when it reaches a resistance level, it might drop down.

Use entry signals like bullish or bearish candles. For example, at a support level, look for a bullish reversal candle. At a resistance level, look for a bearish reversal candle.

- Identify support and resistance levels

- Wait for the price to approach these levels

- Look for reversal candles

This strategy is simple yet powerful. It relies on market psychology and common price patterns. Practice it on a demo account to master it.

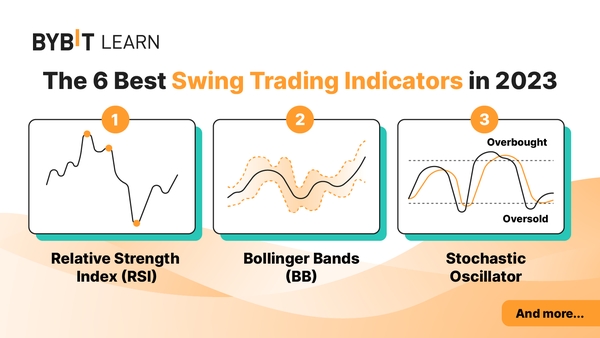

Strategy 3: Relative Strength Index (rsi)

Strategy 3: Relative Strength Index (RSI) is a popular swing trading strategy. It helps traders make informed decisions. RSI measures the speed and change of price movements. This strategy identifies overbought or oversold conditions in the market.

Understanding Rsi

The Relative Strength Index (RSI) is a momentum oscillator. It ranges from 0 to 100. RSI indicates if a stock is overbought or oversold.

An RSI above 70 suggests that a stock is overbought. This means it might be due for a pullback. An RSI below 30 indicates that a stock is oversold. This suggests it might be due for a bounce.

RSI is calculated using the following formula:

RSI = 100 - (100 / (1 + RS))

RS = Average Gain / Average Loss

Traders use RSI to identify trends and potential reversals. It helps in making better trading decisions.

Using Rsi For Entry And Exit

RSI can be used to determine entry and exit points. When RSI is above 70, consider selling or shorting. When RSI is below 30, consider buying or going long.

Here are some steps to use RSI for entry and exit:

- Check the RSI value of the stock.

- If RSI is above 70, prepare to sell.

- If RSI is below 30, prepare to buy.

- Use additional indicators for confirmation.

RSI helps in identifying the right time to enter or exit a trade. It increases the chances of making profitable trades.

RSI is a simple yet powerful tool. It is widely used by swing traders. Incorporating RSI into your strategy can help improve your trading outcomes.

Combining Strategies For Better Results

Combining multiple swing trading strategies can yield superior results. Different techniques complement each other, minimizing risk and maximizing returns. Let’s explore how synergizing strategies can elevate your trading game.

Synergizing Techniques

Using a mix of strategies can optimize performance. Here’s a detailed look:

- Trend Following: Identifying and riding market trends can be profitable.

- Momentum Trading: Capturing gains by exploiting market momentum.

- Breakout Trading: Leveraging significant price movements for quick gains.

Combining these techniques balances risk and return. Each strategy covers the weaknesses of the others.

Maximizing Returns

Mixing strategies helps in achieving higher returns. Here’s how you can do it:

- Identify Trends: Use trend-following to spot long-term movements.

- Confirm Momentum: Validate trends with momentum indicators.

- Execute Breakouts: Act on confirmed breakouts for quick profits.

By following these steps, you can enhance your trading performance. Below is a table summarizing the key elements:

| Strategy | Key Element |

|---|---|

| Trend Following | Identify long-term trends |

| Momentum Trading | Confirm trends with momentum |

| Breakout Trading | Execute confirmed breakouts |

Combining these strategies can improve your trading outcomes. Use each method’s strengths to your advantage.

Risk Management In Swing Trading

Swing trading can be rewarding but involves risks. Risk management is crucial. Effective risk management protects your capital and boosts your confidence. Let’s explore two key components of risk management in swing trading.

Setting Stop-loss Orders

Stop-loss orders help minimize losses. They automatically sell your position at a set price. This limits your loss if the market moves against you.

For example, if you buy a stock at $50, set a stop-loss at $45. If the stock drops to $45, the order executes. This prevents further losses. This strategy is simple yet powerful. It protects your trading capital.

Consider using trailing stop-loss orders. These adjust as the stock price moves in your favor. For instance, if your stock rises to $60, the stop-loss might adjust to $55. This locks in profits while limiting losses.

| Stock Price | Stop-Loss Price |

|---|---|

| $50 | $45 |

| $60 | $55 |

Position Sizing

Position sizing determines how much to invest in a single trade. It helps control risk by limiting exposure.

Use the 1% rule for position sizing. This means risking only 1% of your trading capital on a single trade. If you have $10,000, only risk $100 per trade.

Example Calculation: Trading Capital: $10,000 Risk per Trade: 1% of $10,000 = $100

To calculate position size, use the formula:

Position Size Formula: Position Size = Risk Amount / (Entry Price - Stop-Loss Price) Example: $100 / ($50 - $45) = 20 shares

This way, even if a trade goes wrong, your losses are minimal. Position sizing is essential for long-term success.

Tips For Successful Swing Trading

Success in swing trading requires a mix of discipline, learning, and smart strategies. Below are some essential tips to help you become a successful swing trader. These tips will keep you on track and improve your trading results.

Staying Disciplined

Discipline is vital for successful swing trading. It helps you stick to your plan and avoid emotional decisions. Here are some key points:

- Follow your trading plan: Always stick to your pre-defined rules.

- Set stop-loss orders: Protect your capital by limiting losses.

- Avoid impulsive trades: Emotional trades often lead to losses.

Consistency is the key. Maintain a trading journal to track your progress. This helps you learn from your mistakes and improve your strategies over time.

Continuous Learning

The world of swing trading is always evolving. Continuous learning is essential to stay ahead:

- Read trading books: Expand your knowledge with expert insights.

- Follow market news: Stay updated with the latest financial news and trends.

- Join online forums: Engage with other traders to share experiences and tips.

Attend webinars and take online courses to improve your skills. Knowledge is power, and staying informed makes you a better trader.

Remember, successful swing trading is a journey. Stay disciplined and keep learning to achieve your trading goals.

Credit: www.vectorvest.com

Frequently Asked Questions

What Is The Simplest Swing Trading Strategy?

The simplest swing trading strategy uses moving averages. Buy when the short-term average crosses above the long-term average. Sell when it crosses below.

What Is The Simplest Trading Strategy That Works?

The simplest trading strategy is the moving average crossover. Buy when the short-term average crosses above the long-term average, and sell when it crosses below. This method helps identify trends and manage risks effectively.

What Is The Best Pattern For Swing Trading?

The best pattern for swing trading is the bull flag pattern. It indicates strong upward momentum and potential for gains.

What Are The Three Simple Stock Trading Strategies?

The three simple stock trading strategies are day trading, swing trading, and buy-and-hold investing. Day trading involves buying and selling within a single day. Swing trading focuses on capturing short-term price movements. Buy-and-hold investing aims for long-term gains by holding stocks for an extended period.

Conclusion

Mastering swing trading can boost your profits. These three strategies are simple yet powerful. Practice them consistently for better results. Remember, patience and discipline are key. Always stay informed and adapt to market changes. Start implementing these strategies today to enhance your trading success.

Happy trading!