The best dividend-paying stocks in India for 2024 include ITC, HDFC Bank, and Reliance Industries. These companies have a strong track record of consistent dividend payouts.

Investing in dividend-paying stocks can be a reliable strategy for generating steady income. In India, several companies stand out for their impressive dividend yields and strong financial performance. ITC, HDFC Bank, and Reliance Industries are among the top choices for investors seeking regular dividends.

These companies not only offer attractive dividend yields but also demonstrate robust growth potential. By including such stocks in your portfolio, you can enjoy a mix of income and capital appreciation. Before investing, always conduct thorough research and consider your financial goals.

Factors To Consider in Dividend Paying Stock

Investing in dividend-paying stocks can be rewarding. It provides a steady income stream. But, it’s essential to evaluate key factors before investing. These factors help ensure you make the best choices. Let’s explore these crucial considerations.

Dividend Yield

Dividend yield is a vital metric. It shows how much a company pays in dividends each year relative to its stock price. A higher yield can be attractive. But, an extremely high yield might signal risk. Always compare the yield with industry peers. This helps gauge whether it is reasonable.

Consider this formula for dividend yield:

Dividend Yield (%) = (Annual Dividend per Share / Price per Share) 100

For example, if a company pays Rs. 5 per share annually and the stock price is Rs. 100, the yield is 5%.

Payout Ratio

The payout ratio indicates the percentage of earnings paid as dividends. It helps assess dividend sustainability. A lower payout ratio suggests the company retains earnings for growth. A very high payout ratio might indicate limited growth potential.

Here’s the formula for payout ratio:

Payout Ratio (%) = (Dividends per Share / Earnings per Share) 100

For instance, if the dividend per share is Rs. 4 and earnings per share is Rs. 10, the payout ratio is 40%.

How to Use Golden Crossover Strategy?

Company Stability

Company stability is crucial when selecting dividend-paying stocks. Stable companies often have consistent earnings. They are less likely to cut dividends during tough times. Look for companies with a strong track record. These firms often have a history of paying and increasing dividends.

Consider the following factors to assess stability:

- Revenue and Profit Growth: Check for consistent growth over years.

- Debt Levels: High debt can be risky. Prefer companies with manageable debt.

- Industry Position: Leaders in their industry are generally more stable.

Here’s a sample table for quick reference:

| Factor | Indicator |

|---|---|

| Revenue Growth | Check for 5-10% annual growth |

| Debt Levels | Debt-to-Equity ratio below 1 |

| Industry Position | Top 3 in the sector |

Evaluating these factors ensures you pick the best dividend-paying stocks.

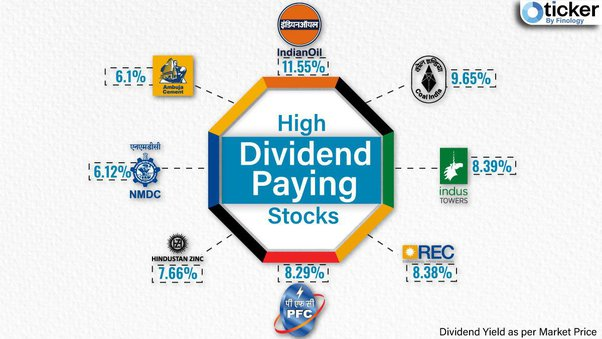

Credit: twitter.com

Top Dividend Stocks

Investing in dividend-paying stocks is a smart way to earn steady income. India has many companies that pay good dividends. In this post, we will explore the best dividend-paying stocks in India for 2024. We will look at large-cap, mid-cap, and small-cap stocks.

Large-cap Stocks

Large-cap stocks are companies with a big market capitalization. They are well-established and offer stable dividends. Here are some of the top large-cap dividend stocks in India:

- Reliance Industries: A giant in the energy sector with a strong dividend history.

- HDFC Bank: Known for its reliable dividend payouts and financial stability.

- Infosys: A leading IT company with consistent dividend payments.

Mid-cap Stocks

Mid-cap stocks are companies with a moderate market capitalization. They offer higher growth potential and good dividend returns. Here are some top mid-cap dividend stocks:

- Bharat Electronics: A defense sector company with promising dividends.

- Voltas: Known for its consumer electronics and consistent dividends.

- Gujarat Gas: A gas distribution company offering good dividend yields.

Small-cap Stocks

Small-cap stocks are companies with a smaller market capitalization. They are riskier but can offer high dividend returns. Here are some top small-cap dividend stocks:

- VST Industries: A tobacco company with high dividend payouts.

- RITES Ltd: Known for its engineering consultancy services and good dividends.

- PTC India: An energy trading company with attractive dividends.

You can Use This Tool To Find The Details of High Paying Dividend Stocks

Sector-wise Analysis

Investing in dividend-paying stocks is a smart way to earn passive income. Different sectors offer different opportunities. Let’s dive into a sector-wise analysis of the best dividend-paying stocks in India for 2024.

Banking Sector

The banking sector is a key player in the Indian economy. Many banks offer attractive dividends to their shareholders. Here are some top dividend-paying banks:

- State Bank of India (SBI): Offers consistent dividends with a solid track record.

- HDFC Bank: Known for its reliability and regular dividend payouts.

- ICICI Bank: Provides good returns and regular dividends.

Banks are crucial for economic growth. Their dividends make them attractive investments.

Pharmaceutical Sector

The pharmaceutical sector is vital for healthcare. Companies in this sector often pay good dividends. Some top picks include:

- Sun Pharmaceutical: Known for consistent dividends and steady growth.

- Dr. Reddy’s Laboratories: Offers reliable dividends and strong performance.

- Cipla: Provides good dividends along with robust growth.

Pharma stocks are a safe bet for dividend seekers. They offer stability and growth.

It Sector

The IT sector is booming and offers lucrative dividends. Top IT companies paying dividends are:

- Infosys: Regular dividends and excellent growth prospects.

- Tata Consultancy Services (TCS): High dividend yield and steady performance.

- Wipro: Consistent dividend payments with good growth.

IT stocks are great for long-term investments. Their dividends are attractive and reliable.

Risks And Challenges

Investing in dividend-paying stocks can be a wise strategy for many investors. Yet, it comes with its set of risks and challenges. Understanding these risks can help you make informed decisions.

Market Volatility

Market volatility can significantly impact the value of your investments. Stock prices can fluctuate wildly due to various factors. These can include geopolitical events, company performance, or global economic trends. High volatility can make it hard to predict returns. This unpredictability can cause stress and financial loss.

Economic Downturns

Economic downturns can severely affect dividend payments. During tough economic times, companies may cut or suspend dividends to conserve cash. This can lead to reduced income for investors relying on these payments. Moreover, stock prices often drop during economic slumps, further impacting your portfolio’s value.

Regulatory Changes

Regulatory changes can pose a significant risk to dividend-paying stocks. Governments may introduce new laws or regulations that affect business operations. These changes can impact a company’s profitability and its ability to pay dividends. Keeping an eye on regulatory news is crucial for investors.

| Risk | Impact |

|---|---|

| Market Volatility | Unpredictable returns, potential losses |

| Economic Downturns | Reduced dividends, lower stock prices |

| Regulatory Changes | Impacts profitability, affects dividend payments |

- Market Volatility: Watch for stock price changes.

- Economic Downturns: Be cautious during economic slumps.

- Regulatory Changes: Stay updated on new laws.

- Understand the market conditions.

- Keep track of economic indicators.

- Monitor regulatory developments.

Investment Strategies

Investing in dividend-paying stocks requires smart strategies. Learn these key strategies to maximize returns.

Long-term Holding

Long-term holding is crucial for dividend stocks. Holding stocks for years allows dividends to compound.

Companies like HDFC Bank and Reliance Industries are great for long-term holding.

These companies have a history of increasing dividends over time.

Dividend Reinvestment

Reinvesting dividends can grow your investment faster. Instead of taking cash, buy more shares.

This way, your dividends generate more dividends. Platforms like Zerodha and Groww offer reinvestment options.

Diversification

Diversify your portfolio to spread risk. Invest in different sectors like banking, IT, and energy.

For example:

- Banking: HDFC Bank, ICICI Bank

- IT: Infosys, TCS

- Energy: Reliance Industries, ONGC

This approach balances high and low-risk stocks.

Tax Implications

Understanding the tax implications of dividend-paying stocks is crucial. It helps investors optimize their returns. This section delves into the key aspects of taxation for dividends in India for 2024.

Dividend Taxation

In India, dividend income is subject to taxation. Since April 1, 2020, dividends are taxed in the hands of shareholders. The tax rate depends on the individual’s income slab.

- For income up to ₹2.5 lakh: No tax

- For income between ₹2.5 lakh and ₹5 lakh: 5%

- For income between ₹5 lakh and ₹10 lakh: 20%

- For income above ₹10 lakh: 30%

Additionally, a 4% Health and Education Cess is applicable. Also, a surcharge may be levied based on the income level.

Tax-efficient Investing

Investors can utilize tax-efficient strategies to enhance their returns. Here are some tips:

- Invest in stocks held in tax-saving accounts.

- Consider investing in companies offering tax-free dividends.

- Use the benefits of Long-Term Capital Gains (LTCG).

| Investment Strategy | Tax Benefit |

|---|---|

| Tax-Saving Accounts | Exemption on dividends |

| Tax-Free Dividends | No tax on certain dividends |

| LTCG | Lower tax rates on long-term gains |

By being aware of the tax implications, investors can maximize their returns. Understanding the tax rules is key to smart investing.

Frequently Asked Questions

Which Stock Pays The Highest Dividend In 2024?

As of now, it’s difficult to predict which stock will pay the highest dividend in 2024. Check financial news and updates regularly for accurate information.

Which Indian Stock Pays The Highest Dividend?

Coal India often pays the highest dividend among Indian stocks. It has a strong track record of consistent payouts.

Which Company Is Giving Dividends In 2024?

Several companies are expected to give dividends in 2024. Some notable examples include Apple, Microsoft, and Johnson & Johnson. Always check the latest financial reports for up-to-date information.

What Are The Top 5 Dividend Stocks To Buy?

Here are the top 5 dividend stocks to buy: Johnson & Johnson, Procter & Gamble, Coca-Cola, Verizon Communications, and AT&T. These companies offer consistent dividends and strong financial stability.

Conclusion

Selecting the best dividend-paying stocks in India for 2024 can enhance your investment portfolio. These stocks offer consistent returns and financial growth. Research and diversify your investments to maximize gains. Stay informed about market trends and company performance. Happy investing, and may your financial journey be prosperous!