Narrow Range 7 (Nr7) Breakout Strategy identifies trading opportunities by focusing on the smallest range of the last seven days. Traders use this strategy to capitalize on potential breakouts.

The Narrow Range 7 (Nr7) Breakout Strategy is popular among traders for its simplicity and effectiveness. It identifies the smallest trading range over the past seven days, indicating potential breakout points. This strategy helps traders pinpoint moments of low volatility, which often precede significant market movements.

By focusing on these narrow ranges, traders can better anticipate and react to price shifts. This method is particularly useful in volatile markets where quick, decisive actions are crucial. Traders often combine Nr7 with other indicators to enhance accuracy and minimize risks. Overall, the Nr7 strategy is a valuable tool in a trader’s arsenal.

Introduction To Nr7 Breakout Strategy

The Narrow Range 7 (Nr7) Breakout Strategy is a powerful tool for traders. It helps identify potential breakout points in the market. This strategy focuses on market volatility and tight trading ranges.

What Is Nr7?

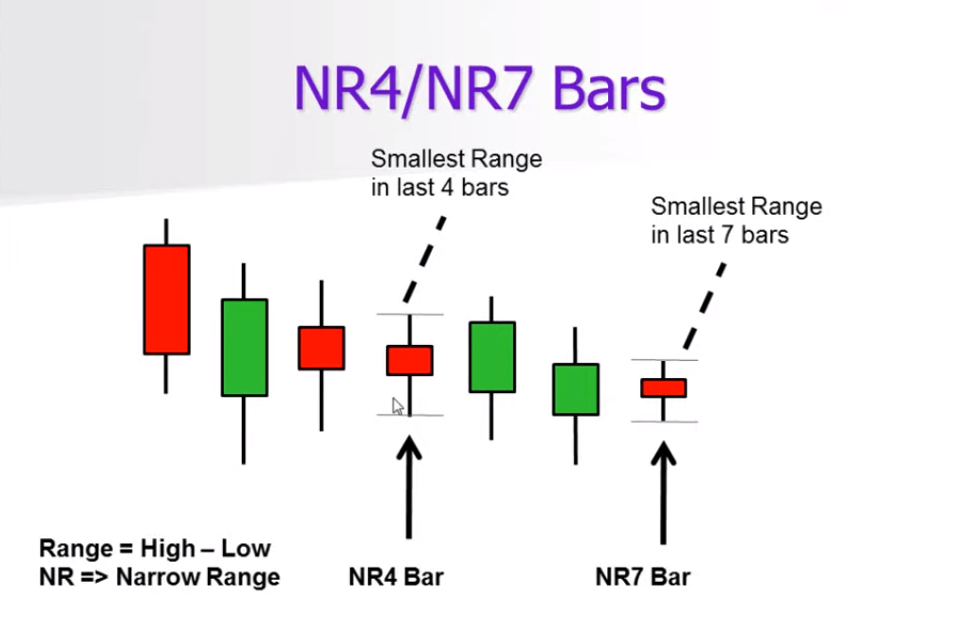

Nr7 stands for Narrow Range 7. It means the trading day’s range is the narrowest in the last seven days. This range includes the difference between the highest and lowest prices.

Traders look for these narrow ranges because they often precede significant price movements. The concept is simple: a period of low volatility is usually followed by a period of high volatility.

Importance In Trading

The Nr7 strategy is crucial for traders who want to catch early breakouts. Identifying narrow ranges can help anticipate explosive moves.

Here are some benefits of using the Nr7 Breakout Strategy:

- Early detection of price breakouts

- Reduced risk due to tight stop-loss levels

- Increased profit potential from significant price moves

| Day | High Price | Low Price | Range |

|---|---|---|---|

| Day 1 | $110 | $100 | $10 |

| Day 2 | $112 | $101 | $11 |

| Day 3 | $115 | $105 | $10 |

| Day 4 | $117 | $108 | $9 |

| Day 5 | $118 | $109 | $9 |

| Day 6 | $120 | $110 | $10 |

| Day 7 | $121 | $115 | $6 |

In the table above, Day 7 shows the narrowest range. This signals a potential breakout. Traders should watch for price movements beyond this range.

What is Bullish Engulfing Candlestick Pattern? A Trader’s Guide

Key Concepts Of Nr7

The Narrow Range 7 (Nr7) Breakout Strategy is a popular trading method. It helps traders identify potential breakout opportunities. Understanding its key concepts is crucial for effective trading. Let’s dive into the core ideas behind this strategy.

Definition Of Narrow Range

A Narrow Range refers to a trading day with a smaller price range than the previous six days. In other words, the day’s high and low prices are closer compared to the past six days. This indicates reduced volatility and potential for a breakout.

Traders often use the abbreviation Nr7 to denote this pattern. It means the seventh day has the narrowest range among the last seven days.

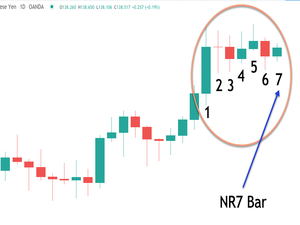

Identifying Nr7 Patterns

To identify Nr7 patterns, traders can follow these simple steps:

- Review the high and low prices of the last seven days.

- Compare the current day’s range with the previous six days.

- If today’s range is the smallest, mark it as an Nr7 day.

Here is a quick table to illustrate:

| Day | High | Low | Range |

|---|---|---|---|

| Day 1 | 105 | 95 | 10 |

| Day 2 | 110 | 100 | 10 |

| Day 3 | 108 | 98 | 10 |

| Day 4 | 106 | 96 | 10 |

| Day 5 | 107 | 97 | 10 |

| Day 6 | 109 | 99 | 10 |

| Day 7 | 104 | 101 | 3 |

In this example, Day 7 has the narrowest range (3). Therefore, it is an Nr7 day.

Recognizing these patterns can signal potential breakouts. This helps traders make informed decisions.

How to Use Golden Crossover Strategy? Maximize Your Gains

Setting Up For Nr7 Breakouts

Setting up for Nr7 breakouts requires proper tools and knowledge. Focus on technical indicators and chart setup. Follow these steps to ensure a successful Nr7 breakout strategy.

Technical Indicators

Technical indicators help identify potential Nr7 breakouts. Use the following indicators to enhance your strategy:

- Moving Averages: Track the average price over a period.

- Relative Strength Index (RSI): Measure the speed and change of price movements.

- Bollinger Bands: Identify volatility and potential breakout points.

- Volume: Confirm the strength of a breakout.

These indicators provide valuable insights. They help predict when a breakout will occur.

Chart Setup

Proper chart setup is crucial for visualizing Nr7 patterns. Follow these tips for an effective chart setup:

- Select the Right Time Frame: Use daily or hourly charts for Nr7 patterns.

- Apply Indicators: Add moving averages, RSI, and Bollinger Bands to your chart.

- Mark Nr7 Candles: Identify the narrowest range candle in the last seven candles.

- Highlight Key Levels: Mark support and resistance levels on your chart.

Using a clear and organized chart setup aids in spotting Nr7 breakouts. This makes it easier to make informed trading decisions.

For better clarity, observe the following table:

| Indicator | Purpose |

|---|---|

| Moving Averages | Track average price over time |

| RSI | Measure speed and change of price |

| Bollinger Bands | Identify volatility |

| Volume | Confirm breakout strength |

Remember to review your charts regularly. This keeps you updated on potential Nr7 breakouts.

Use This Free Application To Identify Free Stocks

Entry And Exit Strategies

The Narrow Range 7 (Nr7) Breakout Strategy is a popular trading method. It helps traders identify potential breakout points. This section will discuss entry and exit strategies for this approach.

Optimal Entry Points

Finding the right entry point is crucial. Traders look for the smallest range bar in the last seven days. This is known as the Nr7 bar.

Steps to identify an entry point:

- Observe the past seven bars.

- Identify the bar with the smallest range.

- Place a buy order above the high of the Nr7 bar.

- Set a sell order below the low of the Nr7 bar.

This method helps in capturing potential breakouts efficiently.

Effective Exit Strategies

Exit strategies are just as important. They help lock in profits and minimize losses.

Two main exit strategies:

- Profit Target: Set a predefined profit target. For example, 2 times the risk amount.

- Trailing Stop: Use a trailing stop to protect gains. Adjust the stop price as the market moves in your favor.

Traders often combine these strategies for better results. A trailing stop can secure profits while allowing for further gains.

Here is a quick comparison of the two strategies:

| Strategy | Pros | Cons |

|---|---|---|

| Profit Target | Locks in profits quickly | May miss larger moves |

| Trailing Stop | Allows for larger gains | May get stopped out early |

Choose the strategy that fits your trading style best.

Risk Management

Effective risk management is crucial in trading the Narrow Range 7 (Nr7) Breakout Strategy. It helps you protect your capital and enhance your profitability. This section will cover essential aspects of risk management, focusing on position sizing and stop-loss techniques.

Position Sizing

Position sizing determines how much of your capital to risk on a trade. Proper position sizing can protect you from significant losses. Here are some key points:

- Always risk a small percentage of your capital.

- Use a risk calculator to determine your position size.

- Aim to risk no more than 2% of your capital per trade.

| Capital | Risk per Trade | Position Size |

|---|---|---|

| $10,000 | 2% | $200 |

| $20,000 | 2% | $400 |

| $50,000 | 2% | $1,000 |

By following these guidelines, you can minimize your risk and trade more confidently.

Stop-loss Techniques

Stop-loss orders help limit your losses in adverse market conditions. Here are some effective stop-loss techniques:

- Fixed Percentage Stop-Loss: Set a stop-loss at a fixed percentage below your entry price.

- Volatility-Based Stop-Loss: Use the average true range (ATR) to set stop-loss levels based on market volatility.

- Support and Resistance Levels: Place stop-loss orders at key support or resistance levels.

Here is an example of how these techniques can be applied:

Entry Price: $100

Fixed Percentage Stop-Loss: 2% (Stop-Loss Price: $98)

Volatility-Based Stop-Loss: 1.5 ATR (ATR = 1.5, Stop-Loss Price: $97.75)

Support Level Stop-Loss: Nearest support level at $97

Implementing these stop-loss techniques can help you manage risk and protect your capital.

Credit: investarindia.com

Backtesting The Nr7 Strategy

Backtesting the Nr7 Strategy is crucial for traders. It helps assess its effectiveness before applying it in real-time trading. This section will delve into the importance of backtesting and how to analyze the results.

Importance Of Backtesting

Backtesting involves testing a trading strategy on historical data. This process helps identify its strengths and weaknesses. It provides a clear picture of the strategy’s performance.

There are several key benefits to backtesting the Nr7 Strategy:

- Risk Management: Understand potential losses before investing real money.

- Performance Insight: Evaluate the strategy’s success rate over time.

- Data-Driven Decisions: Make informed decisions based on historical performance.

To conduct a thorough backtest, follow these steps:

- Collect historical price data for the chosen asset.

- Apply the Nr7 rules to identify potential breakout points.

- Record the outcomes of these potential breakouts.

Analyzing Results

Analyzing backtest results is essential for refining the Nr7 Strategy. Focus on these metrics:

| Metric | Description |

|---|---|

| Win Rate | Percentage of profitable trades. |

| Average Gain | Average profit from winning trades. |

| Average Loss | Average loss from losing trades. |

| Profit Factor | Ratio of total profit to total loss. |

High win rates and profit factors indicate a strong strategy. Low average losses show effective risk management.

Adjust the strategy based on these results. This process helps improve overall performance. Backtesting and result analysis are vital for successful trading.

Common Mistakes To Avoid

Trading the Narrow Range 7 (Nr7) Breakout Strategy can be profitable. Yet, many traders often make avoidable mistakes. Understanding and avoiding these mistakes can enhance your trading success.

Overtrading

Overtrading is a common mistake many traders make. They see potential trades everywhere. This often leads to unnecessary losses. The Nr7 strategy requires patience. Not every day will present an ideal trade setup.

To avoid overtrading, follow these tips:

- Stick to your trading plan.

- Wait for clear Nr7 patterns.

- Limit the number of trades per day.

Discipline is key. Overtrading can drain your account quickly.

Ignoring Market Conditions

Ignoring market conditions is another critical mistake. The market environment affects the effectiveness of the Nr7 strategy. Trading during high volatility can lead to false breakouts.

Consider the following tips:

- Check overall market trends.

- Analyze current volatility levels.

- Avoid trading during major news events.

By being aware of market conditions, you can improve your trading accuracy.

| Common Mistake | Solution |

|---|---|

| Overtrading | Stick to the plan, limit trades, wait for clear patterns. |

| Ignoring Market Conditions | Analyze trends, check volatility, avoid trading during news. |

Case Studies And Examples

The Narrow Range 7 (Nr7) Breakout Strategy is a popular trading method. It helps traders identify potential breakouts. By analyzing historical data, we can learn a lot. This section will explore real-life examples and case studies.

Successful Nr7 Trades

Let’s look at some successful trades using the Nr7 strategy. These examples will help understand how the strategy works.

| Date | Stock | Entry Price | Exit Price | Profit |

|---|---|---|---|---|

| Jan 10, 2023 | ABC Corp | $100 | $110 | $10 |

| Feb 15, 2023 | XYZ Inc | $200 | $220 | $20 |

In these trades, the entry price was identified using the Nr7 strategy. The exit price was determined based on set targets. Both trades resulted in profits.

Lessons Learned

From these trades, we can learn valuable lessons:

- Patience is key. Wait for the right setup.

- Set clear targets for entry and exit.

- Always use stop-loss to manage risk.

These lessons help improve trading skills. They also help in making better decisions.

Understanding these examples and lessons can enhance your trading strategy. Keep practicing and stay disciplined.

Tools And Resources

To effectively use the Narrow Range 7 (Nr7) Breakout Strategy, you need the right tools and resources. This section covers the essential software and educational materials to help you succeed.

Software Recommendations

Choosing the right software can make or break your trading strategy. Here are some top recommendations:

| Software | Features |

|---|---|

| TradingView | Advanced charting tools, community scripts, and custom alerts. |

| MetaTrader 4 | Supports automated trading, technical analysis, and multiple time frames. |

| Thinkorswim | Real-time data, extensive indicators, and paper trading. |

Educational Resources

Learning the Nr7 Breakout Strategy requires quality educational resources. Here are some recommended resources:

- Online Courses: Websites like Udemy and Coursera offer courses on trading strategies, including Nr7.

- Books: “Technical Analysis of the Financial Markets” by John Murphy is a must-read.

- Webinars: Attend live sessions from experts to gain practical insights.

- Forums: Join communities like Trade2Win and Elite Trader for peer support and advice.

Equip yourself with these tools and resources to master the Nr7 Breakout Strategy.

Credit: forextraininggroup.com

Frequently Asked Questions

What Is The Narrow Range 7 Strategy?

The narrow range 7 strategy identifies stocks with seven consecutive days of narrowing price ranges. Traders use it to spot breakout opportunities.

Is Nr7 A Good Strategy?

Yes, NR7 can be a good strategy for traders. It focuses on narrow range patterns, helping identify potential breakout opportunities.

What Is The Narrow Range Breakout Indicator?

The narrow range breakout indicator identifies periods of low volatility. Traders use it to predict potential price breakouts. This tool helps in spotting significant market movements. It enhances trading strategies by signaling entry and exit points.

What Is The Success Rate Of Opening Range Breakout Strategy?

The success rate of the opening range breakout strategy varies. It depends on market conditions and trader skill. Generally, success rates range from 50% to 70%.

Conclusion

Mastering the Narrow Range 7 (Nr7) Breakout Strategy can elevate your trading success. This technique offers clear entry and exit points. Consistent practice and analysis are key. Implement this strategy to refine your trading skills. Stay disciplined and patient for optimal results.

Enhance your trading portfolio with the Nr7 Breakout Strategy. Happy trading!