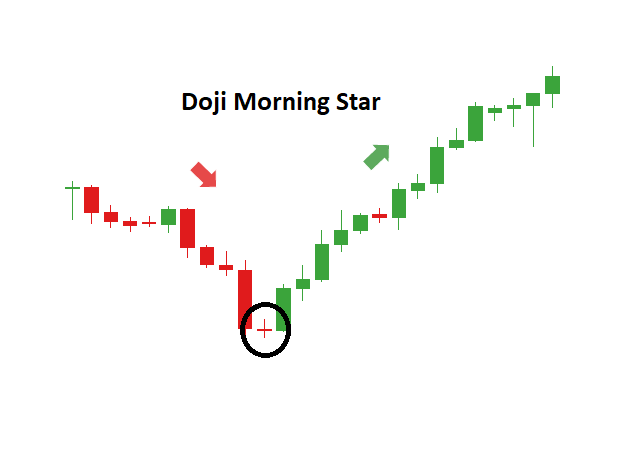

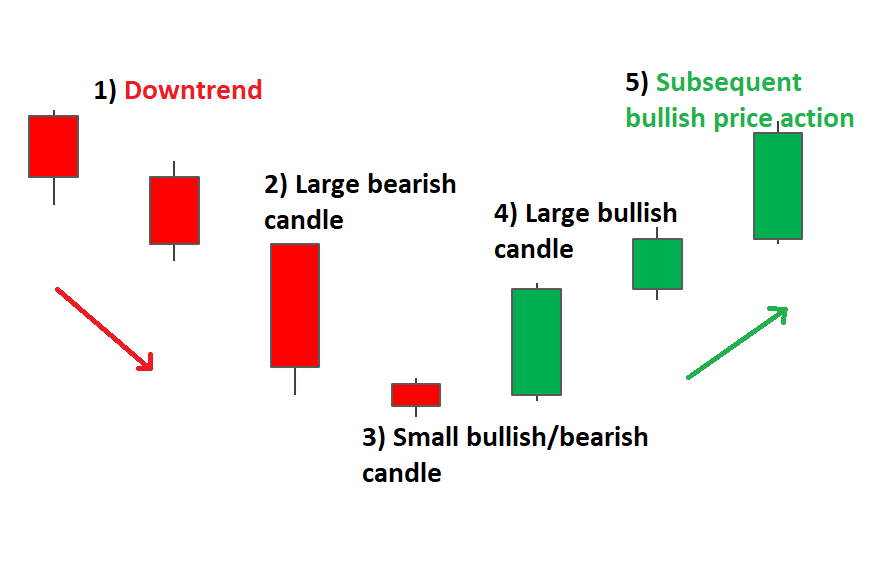

The Morning Star Candlestick Pattern is a bullish reversal pattern that indicates potential upward price movement. It consists of three candles: a large bearish candle, a small-bodied candle, and a large bullish candle.

The Morning Star Candlestick Pattern is significant in technical analysis for predicting market trends. This pattern typically forms after a downtrend, signaling a potential shift in market sentiment. The first candle shows strong selling pressure, the second candle indicates indecision, and the third candle suggests buying strength.

Traders often look for this pattern to identify buying opportunities. Recognizing this pattern can help in making informed trading decisions. It is essential for traders to confirm this pattern with other indicators to ensure its reliability. Understanding this pattern can improve trading strategies and outcomes.

Introduction To Morning Star

The Morning Star candlestick pattern is a visual indicator used in technical analysis. It helps traders identify potential bullish reversals in the market. This pattern forms over three days and signals the end of a downtrend.

Candlestick Basics

Candlestick charts display price movements over time. Each candlestick shows four key prices: open, high, low, and close.

- Open: The first price traded during the candlestick period.

- High: The highest price reached during the period.

- Low: The lowest price traded during the period.

- Close: The last price traded during the candlestick period.

Candlesticks can be either bullish or bearish. Bullish candlesticks close higher than they open. Bearish candlesticks close lower than they open.

Significance In Trading

The Morning Star pattern is crucial for traders. It signals a potential reversal from a downtrend to an uptrend.

| Day | Characteristics |

|---|---|

| Day 1 | Large bearish candlestick |

| Day 2 | Small-bodied candlestick (could be bullish or bearish) |

| Day 3 | Large bullish candlestick |

Traders use this pattern to make buying decisions. The formation of a Morning Star suggests the downtrend is weakening. It shows buyers are starting to take control.

Identifying The Pattern

The Morning Star Candlestick Pattern is a powerful signal in trading. It helps traders identify potential bullish reversals. Recognizing this pattern involves observing three specific candlesticks. Each candlestick plays a crucial role in forming the Morning Star.

First Candlestick

The first candlestick in the Morning Star pattern is a long bearish candlestick. It indicates strong selling pressure. The body of this candlestick is large and red. This shows the market is currently in a downtrend.

Second Candlestick

The second candlestick is small and can be bearish or bullish. This candlestick often has a small body. It represents indecision in the market. The color of this candlestick is less important than its size. It shows that the selling pressure is losing momentum.

Third Candlestick

The third candlestick is a long bullish candlestick. It indicates strong buying pressure. This candlestick closes above the midpoint of the first candlestick. The body of this candlestick is large and green. It confirms the reversal signal in the market.

Below is a summary table for quick reference:

| Candlestick | Description | Significance |

|---|---|---|

| First | Long bearish candlestick | Indicates strong selling pressure |

| Second | Small candlestick (bearish or bullish) | Represents market indecision |

| Third | Long bullish candlestick | Indicates strong buying pressure |

Identifying the Morning Star Candlestick Pattern involves observing these three steps. It can help traders make informed decisions. Recognizing this pattern can be a useful addition to any trading strategy.

Psychology Behind The Pattern

The Morning Star Candlestick Pattern is a powerful tool for traders. It often signals a potential reversal in the market. Understanding the psychology behind this pattern can help traders make better decisions. Let’s dive into the market sentiment and trader behavior that drive this pattern.

Market Sentiment

The Morning Star pattern reflects a shift in market sentiment. Initially, the market is in a downtrend. This shows that bearish sentiment dominates. The first candle is usually a long bearish candle. It confirms the ongoing downtrend.

The second candle is a small-bodied candle. It can be either bullish or bearish. This candle indicates indecision among traders. The market is searching for direction. The third candle is a long bullish candle. It signals a shift towards bullish sentiment.

Trader Behavior

The Morning Star pattern also highlights changes in trader behavior. During the first candle, many traders are selling. Fear and pessimism drive this behavior. The second candle shows that selling pressure is weakening. Traders are uncertain about the market’s next move.

The third candle reflects a change in trader behavior. Many traders start buying, driven by optimism. They believe the market is set to rise. This shift in trader behavior often leads to a market reversal.

Understanding these aspects can help traders spot potential opportunities. It is crucial to observe both market sentiment and trader behavior. This knowledge can improve trading decisions and outcomes.

| Stage | Candle Type | Market Sentiment | Trader Behavior |

|---|---|---|---|

| First | Long Bearish | Bearish | Selling |

| Second | Small-bodied | Indecision | Uncertainty |

| Third | Long Bullish | Bullish | Buying |

- Morning Star indicates a potential market reversal.

- First candle shows bearish sentiment.

- Second candle reflects market indecision.

- Third candle signifies a shift to bullish sentiment.

:max_bytes(150000):strip_icc()/Term-Definitions_shootingstar-f1bfe827e17442b28f465928a5bc9a43.jpg)

Credit: www.investopedia.com

Real-world Examples

Understanding the Morning Star Candlestick Pattern becomes easier with real-world examples. Analyzing historical data and recent instances can provide valuable insights. This helps to see the practical application of this pattern in stock trading.

Historical Data

Historical data shows how the Morning Star pattern has worked over time. Let’s explore some examples from well-known stocks.

| Stock | Date | Price Before | Price After |

|---|---|---|---|

| Apple Inc. | March 15, 2018 | $160 | $170 |

| Microsoft Corp. | July 10, 2019 | $130 | $140 |

For instance, Apple Inc. showed a Morning Star pattern on March 15, 2018. The stock price rose from $160 to $170. Similarly, Microsoft Corp. displayed this pattern on July 10, 2019. The price increased from $130 to $140.

Recent Instances

Recent instances of the Morning Star pattern can also be seen. These patterns have appeared in several stocks, indicating potential price increases.

- Tesla Inc. – April 20, 2021: From $700 to $730

- Amazon.com Inc. – June 5, 2021: From $3100 to $3200

In recent times, Tesla Inc. formed a Morning Star pattern on April 20, 2021. The stock price moved from $700 to $730. Amazon.com Inc. showed this pattern on June 5, 2021, with the price rising from $3100 to $3200.

These examples illustrate the effectiveness of the Morning Star pattern. Traders can use this pattern to predict potential price movements.

Trading Strategies

Understanding the Morning Star Candlestick Pattern is key for traders. This pattern signals a potential bullish reversal. Knowing how to trade with this pattern can boost your success. Let’s dive into the trading strategies involving entry and exit points.

Entry Points

Entry points are crucial in trading the Morning Star Candlestick Pattern. The pattern consists of three candles:

- A long bearish candle

- A small indecisive candle

- A long bullish candle

To enter a trade, look for these characteristics:

- The first candle is a large red candle.

- The second candle is small and can be red or green.

- The third candle is a large green candle.

Enter the trade at the opening of the fourth candle. Ensure the third candle closes above the midpoint of the first candle.

Exit Points

Exit points are as important as entry points. To maximize profits, consider these strategies:

- Set a target price based on the height of the pattern.

- Use trailing stops to lock in profits as the price rises.

- Monitor for signs of a bearish reversal to exit early.

Here is a simple table to summarize:

| Strategy | Details |

|---|---|

| Target Price | Height of the pattern |

| Trailing Stops | Adjust as price rises |

| Bearish Reversal | Exit early if reversal detected |

By using these exit strategies, you can protect your investments.

Credit: m.youtube.com

Risk Management

Risk management is crucial when trading using the Morning Star Candlestick Pattern. Proper risk management helps minimize losses and protect profits. Let’s explore essential techniques to manage risk effectively.

Stop-loss Techniques

Stop-loss orders are vital in trading. They limit potential losses. Place a stop-loss below the low of the Morning Star Pattern.

- Identify the lowest point of the Morning Star.

- Set the stop-loss a few pips below this point.

- Adjust the stop-loss as the trade progresses.

Using stop-loss orders ensures you exit trades before significant losses.

Position Sizing

Position sizing determines how much to invest in a trade. It helps manage risk effectively. Use the following steps to size your positions:

- Determine your risk tolerance (e.g., 1% of your capital).

- Calculate the difference between entry and stop-loss price.

- Divide your risk amount by this difference.

Position sizing ensures you don’t risk too much on a single trade.

Here’s a simple table to summarize:

| Step | Action | Example |

|---|---|---|

| 1 | Determine risk tolerance | 1% of $10,000 = $100 |

| 2 | Calculate entry-stop difference | $50 – $45 = $5 |

| 3 | Divide risk by difference | $100 / $5 = 20 shares |

Using these techniques, you can trade the Morning Star Pattern with confidence.

Common Mistakes

Understanding the Morning Star Candlestick Pattern can be challenging. Traders often make common mistakes that affect their success. Let’s explore these errors to avoid potential pitfalls.

Misinterpretation

One frequent mistake is the misinterpretation of the pattern. Traders might confuse the Morning Star with other patterns. Here are some points to keep in mind:

- Ensure the first candle is a long bearish one.

- The second candle should be a small body, indicating indecision.

- The third candle must be a long bullish one, confirming the reversal.

Misidentifying these elements can lead to incorrect trades. Always verify the pattern’s characteristics.

Overconfidence

Another mistake is overconfidence in the pattern’s reliability. No pattern guarantees success. Even the Morning Star can fail in certain conditions. Consider these points:

- Always use the pattern with other indicators.

- Analyze the overall market trend.

- Be mindful of news and events that can impact the market.

Relying solely on the Morning Star can lead to losses. Diversify your analysis methods to increase accuracy.

Credit: www.dailyfx.com

Advanced Techniques

Mastering the Morning Star Candlestick Pattern can boost your trading skills. Understanding advanced techniques can help you make better decisions. Here, we’ll explore two key techniques: combining indicators and algorithmic trading.

Combining Indicators

Combining the Morning Star Candlestick Pattern with other indicators can improve accuracy. Here are some useful indicators to combine:

- Moving Averages: Identify trends and confirm the Morning Star pattern.

- Relative Strength Index (RSI): Check for overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Confirm momentum and potential trend reversals.

Using these indicators together can provide a more robust trading strategy.

Algorithmic Trading

Algorithmic trading involves using computers to execute trades based on predefined criteria. Incorporating the Morning Star Candlestick Pattern into an algorithm can automate trading decisions.

Here’s an example of a simple algorithm using the Morning Star pattern:

if (MorningStarPattern == true) {

buy(stock);

}

Using algorithms can help reduce emotional trading and improve consistency.

Advanced traders often use more complex algorithms. These may include multiple indicators and risk management rules.

Combining the Morning Star Candlestick Pattern with algorithmic trading can lead to more efficient trading.

Resources For Further Learning

Exploring the Morning Star Candlestick Pattern can greatly enhance your trading skills. To deepen your knowledge, consider diving into various resources. Below are some excellent options for further learning.

Books And Articles

Books and articles are valuable for detailed insights. They often provide in-depth analysis and historical context. Here are some must-reads:

- “Japanese Candlestick Charting Techniques” by Steve Nison – This book is a comprehensive guide to candlestick charting.

- “Technical Analysis of the Financial Markets” by John Murphy – This book covers various technical analysis tools, including candlestick patterns.

- Investopedia Articles – Websites like Investopedia offer many articles on the Morning Star pattern.

Online Courses

Online courses provide structured learning and often include interactive elements. Consider these courses:

- Udemy’s “Candlestick Trading Mastery” – This course covers all you need to know about candlestick patterns.

- Coursera’s “Technical Analysis” – This course, offered by top universities, includes modules on candlestick patterns.

- Babypips School of Pipsology – This free resource covers many aspects of technical analysis, including candlestick patterns.

Frequently Asked Questions

Is The Morning Star Bullish Or Bearish?

The morning star is a bullish candlestick pattern. It signals a potential reversal from a downtrend to an uptrend.

What Is The Difference Between Morning Star And Evening Star Candlestick?

A Morning Star candlestick pattern signals a bullish reversal, appearing at the end of a downtrend. An Evening Star candlestick pattern indicates a bearish reversal, showing up at the end of an uptrend.

What Is The Most Powerful Candlestick Pattern?

The most powerful candlestick pattern is the “Engulfing Pattern”. It signals a potential trend reversal and strong market sentiment.

How Reliable Is Morning Star Candlestick Pattern?

The Morning Star candlestick pattern is reliable for indicating potential bullish reversals. Traders often use it alongside other indicators. Its effectiveness increases with volume confirmation.

Conclusion

The Morning Star candlestick pattern is a powerful tool for traders. It signals potential bullish reversals. Understanding its components can enhance trading strategies. Use this pattern to make informed decisions. Always combine it with other indicators for best results. Happy trading and stay informed for market success!