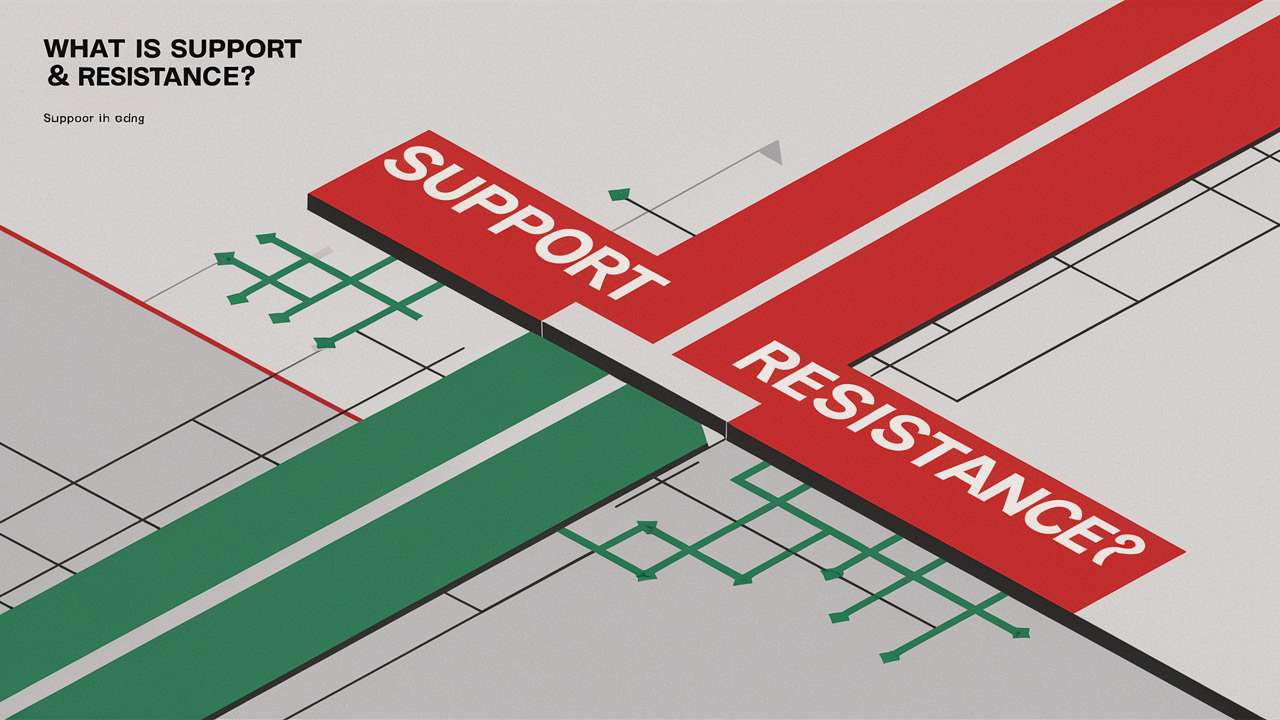

Support and resistance are key concepts in technical analysis. They indicate price levels where an asset tends to stop and reverse.

Support represents a price level where a downtrend can pause due to a concentration of demand. Resistance, on the other hand, is a price level where a rising trend can halt due to a concentration of selling interest. Traders use these levels to make informed decisions about entry and exit points in the market.

Identifying support and resistance helps in predicting future price movements and managing risk. These levels often form the foundation of various trading strategies, making them essential for both novice and experienced traders. Understanding and utilizing support and resistance can significantly enhance trading performance.

Introduction To Market Dynamics

Understanding market dynamics is crucial for successful trading. Market dynamics involve the forces that impact price movements. Two key elements in these dynamics are support and resistance. These concepts help traders make better decisions. Let’s explore their importance and the psychology behind them.

Importance Of Support & Resistance

Support and resistance levels are essential in trading. They are the points where prices often reverse. Support is the level where a price tends to stop falling. It acts as a floor, preventing further decline. Resistance is the level where a price tends to stop rising. It acts as a ceiling, preventing further increase.

Knowing these levels can help traders plan their entries and exits. It can also help in setting stop-loss orders. This minimizes risks and maximizes profits. Let’s look at some key points:

- Support Level: Price stops falling here.

- Resistance Level: Price stops rising here.

- Traders Use: Plan entries, exits, and stop-loss orders.

Market Psychology

Market psychology plays a big role in support and resistance. Traders’ actions at these levels are often predictable. At support levels, buyers enter the market. They believe the price will rise from here. At resistance levels, sellers come in. They believe the price will fall from here.

This behavior creates a cycle. It often repeats until a major event breaks the pattern. Understanding this psychology helps traders anticipate market moves. Here is a simple table to illustrate:

| Level | Action | Psychology |

|---|---|---|

| Support | Buy | Price will rise |

| Resistance | Sell | Price will fall |

In summary, support and resistance levels are more than just lines on a chart. They are indicators of market behavior. Recognizing these levels and understanding the psychology behind them can improve trading strategies.

Use STOCK EDGE FOR FINDING TRENDING STOKCKS FREE TO OPEN AND USE

:max_bytes(150000):strip_icc()/dotdash_Final_Support_and_Resistance_Basics_Aug_2020-01-1c737e0debbe49a88d79388977f33b0c.jpg)

Credit: www.investopedia.com

Defining Support

Support is a key concept in technical analysis. It refers to a price level where a stock tends to find buying interest. When the price drops to this level, it is met with enough buying demand to prevent it from falling further.

Support levels can be identified using past price data. These levels help traders make decisions about buying and selling.

Narrow Range 7 (Nr7) Breakout Strategy

Key Characteristics

- Historical Data: Support levels are often identified based on past prices.

- Price Floor: It acts as a floor, preventing prices from falling below a certain level.

- Psychological Impact: These levels can influence trader behavior and market sentiment.

- Volume: High trading volume at a support level strengthens its validity.

Identifying Support Levels

Identifying support levels involves analyzing historical price data. Here are some methods:

- Chart Patterns: Look for recurring price patterns that indicate support.

- Moving Averages: Use moving averages to identify potential support levels.

- Trend Lines: Draw trend lines to see where prices have previously held firm.

- Volume Analysis: Check for high trading volumes at specific price points.

These methods help traders find reliable support levels. They can then make informed trading decisions.

Defining Resistance

Understanding resistance in trading is crucial for making informed decisions. Resistance represents a price level where selling pressure overcomes buying pressure. This price level prevents the price from rising further. Traders use resistance to predict price movements.

Key Characteristics

Resistance has distinct characteristics that traders look for:

- Price Level: A specific price that the asset struggles to surpass.

- Volume: High trading volume often accompanies resistance levels.

- Repetition: Prices hit the resistance level multiple times.

- Psychological Factors: Round numbers often act as resistance.

Identifying Resistance Levels

Identifying resistance levels can be done using various methods:

- Historical Data: Check past price charts for repeated peaks.

- Technical Indicators: Use tools like moving averages and Bollinger Bands.

- Trendlines: Draw lines connecting multiple highs.

- Fibonacci Retracement: Apply Fibonacci levels to spot potential resistance.

Using these methods helps traders identify potential resistance points. This can guide their trading strategies.

Credit: optimusfutures.com

Role Of Price Action

The role of price action is crucial in understanding support and resistance. Price action helps traders make informed decisions. It involves analyzing price movements. This approach does not rely on indicators. Instead, it focuses on raw price data. Here, we will explore key aspects of price action.

Candlestick Patterns

Candlestick patterns offer insights into market sentiment. Each candlestick represents price movement over a specific period. Common patterns include:

- Doji: Indicates indecision in the market.

- Hammer: Suggests potential reversal to the upside.

- Shooting Star: Signals possible reversal to the downside.

These patterns help identify support and resistance levels. Traders can use them to predict future price movements.

Volume Reading

Volume Reading enhances the understanding of price action. Volume shows the number of shares traded. It can confirm trends and reversals. Key points to consider:

| Volume Increase | Volume Decrease |

|---|---|

| Confirms strength of price movement. | Indicates weakening trend. |

| Supports breakout from support/resistance. | Suggests false breakout. |

High volume at support levels indicates strong buying interest. Low volume near resistance hints at weak selling pressure. Using volume analysis with price action can improve trading accuracy.

Types Of Support & Resistance

Understanding types of support and resistance is crucial for traders. These levels help in predicting price movements. There are different types of support and resistance levels. Let’s dive into some of the key types.

Static Vs. Dynamic

Static levels do not change with time. They are fixed price points on a chart. Examples include horizontal support and resistance lines. These levels are easy to spot and use.

Dynamic levels change over time. They move with the price and market conditions. Examples include moving averages and trendlines. These levels provide more real-time analysis.

| Type | Description | Examples |

|---|---|---|

| Static | Fixed price points | Horizontal lines |

| Dynamic | Moving with time | Moving averages, Trendlines |

Psychological Levels

Psychological levels are price points where traders react. These levels are often round numbers like 100, 500, or 1000. Traders tend to place orders around these numbers. They act as strong support and resistance points.

- Examples: 50, 100, 200

- Traders often set stop-loss orders here

- These levels are easy to identify

Tools For Analysis

Understanding Support and Resistance is vital in trading. Traders use various tools for analysis to identify these levels. These tools help in predicting price movements and making informed decisions.

Technical Indicators

Technical indicators are mathematical calculations based on price, volume, or open interest. They help traders predict future price movements.

- Moving Averages: Show the average price over a period. Common ones are the 50-day and 200-day moving averages.

- Relative Strength Index (RSI): Measures the speed and change of price movements. Values above 70 indicate overbought conditions. Values below 30 indicate oversold conditions.

- Bollinger Bands: Consist of a middle band and two outer bands. They help in identifying overbought or oversold conditions.

Chart Patterns

Chart patterns are shapes formed by the price movements on a chart. They signal potential trend reversals or continuations.

- Head and Shoulders: Indicates a reversal from a bullish to a bearish trend. It consists of a peak (head) between two smaller peaks (shoulders).

- Double Top and Double Bottom: Double Top signals a bearish reversal. Double Bottom signals a bullish reversal.

- Triangles: Include ascending, descending, and symmetrical triangles. They indicate a continuation of the current trend.

Using these tools effectively can enhance your trading strategy. They provide insights into market trends and potential price movements.

Trading Strategies

Understanding trading strategies is essential for successful trading. Knowing Support & Resistance levels helps traders make informed decisions. Let’s dive into some popular trading strategies.

Breakouts And Fakeouts

Breakouts occur when the price moves beyond a Support or Resistance level. This indicates a strong trend. Traders often enter trades during breakouts.

Fakeouts happen when the price temporarily moves past a Support or Resistance level but then reverses. This can trap traders. It’s crucial to confirm breakouts before making trades. Use indicators like volume and momentum.

| Scenario | Action |

|---|---|

| Price breaks resistance | Consider buying |

| Price breaks support | Consider selling |

| Fakeout detected | Wait for confirmation |

Range Trading

Range trading is another popular strategy. It involves buying at Support and selling at Resistance. This works well in sideways markets.

Identify a range where the price oscillates between levels. Use oscillators like RSI to confirm overbought and oversold conditions.

- Identify Support and Resistance levels.

- Buy near Support.

- Sell near Resistance.

- Use stop-loss to manage risk.

Range trading requires patience and discipline. Keep an eye on the overall trend. If the trend changes, adjust your strategy accordingly.

Common Mistakes

Understanding Support & Resistance is crucial for any trader. Yet, many make common mistakes. These errors can lead to significant losses. Below, we explore some of these pitfalls.

Over-reliance On Indicators

Many traders depend too much on indicators. They forget to analyze the price itself. Indicators are tools, not crystal balls. They must be used wisely.

Here are some common errors:

- Using too many indicators.

- Ignoring the basics of price action.

- Relying on one type of indicator only.

Using many indicators can clutter your chart. This can lead to confusion. Stick to a few reliable ones.

| Common Indicators | Purpose |

|---|---|

| Moving Averages | Identify trend direction |

| RSI | Measure market momentum |

| Bollinger Bands | Determine volatility |

Ignoring Market Context

Understanding the broader market context is vital. Some traders ignore this. They focus only on specific levels.

Consider these factors:

- Overall market trend.

- Economic news and events.

- Volume of trades.

The market trend shows the bigger picture. Economic news can impact prices drastically. High trade volume often confirms strong support or resistance levels.

Always keep the market context in mind. It helps you make informed decisions.

:max_bytes(150000):strip_icc()/dotdash_Final_Support_and_Resistance_Basics_Aug_2020-05-7e30073592844fcc85ef1c54e3dda77c.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

What Does Support And Resistance Really Tell You?

Support and resistance identify price levels where an asset tends to stop and reverse. Support indicates a price floor. Resistance marks a price ceiling. These levels help traders make informed decisions.

What Is Support And Resistance For Beginners?

Support is a price level where a stock tends to stop falling. Resistance is where a stock tends to stop rising.

How To Read Stock Chart Support And Resistance?

To read stock chart support, find the price level where the stock tends to stop falling. For resistance, identify where the stock stops rising. Use historical data to spot these levels. Look for multiple touches at the same price points.

How To Know If A Support Or Resistance Will Hold?

To determine if support or resistance will hold, look for strong volume, previous tests, and candlestick patterns. Analyze market trends and use technical indicators like RSI or moving averages.

Conclusion

Understanding support and resistance is crucial for successful trading. These concepts help predict market movements. By mastering them, traders can make informed decisions. Always analyze the market carefully and use support and resistance levels to your advantage. This knowledge can significantly enhance your trading strategy and outcomes.